There is no denying that any diamond is beautiful in any fashion. Suppose they are set in a gold setting as an engagement ring or laying as loose diamonds on a delicate piece of black velvet evaluated by the diamond expert. Diamonds can turn heads and make customers inquire about them. Diamonds are considered one of the precious materials available for investment or owning. Whether natural diamonds or lab-grown diamonds, they are sought after as a safe investment.

Gold is one of the most highly sought-after precious metals out on the market today. Over the past ten years, gold prices have skyrocketed. Gold prices are based on the spot price, and it fluctuates and is dependent on market variables.

Let's Talk Gold

Gold prices fluctuate daily based on the current market price. Gold reserves are not used as the gold standard by any government today. Fiat money has entirely replaced the gold standard, which describes value because of a government’s order, thus legal tender. The value of the US Dollar today is volatile due to the coronavirus pandemic, a tumbling US economy, and an increase in the USD money supply.

Gold used for gold jewelry amounted to approximately 442.6 metric tons in the third quarter of 2021. Gold is in demand because it is durable and steady, holds value, and is used as a hedge against inflation. The current demand for gold is high, which raises the price of gold, and the price of gold will shoot up due to high demand from customers.

Gold Pricing

Gold is bought and sold based on the spot price of gold. The critical factor to consider is that the spot price is 24k gold because 24k gold is .99% pure gold. Knowing what type of gold you have is essential in understanding what gold is worth.

10k gold will bring a lower market price because the gold content is less than .10k gold or 41.7% gold, and even though it is worth considering if you are selling or buying gold, it will be worth a lower price of 24k gold.

Gold has been a safe-harbor investment historically. It creates a bumper to purchasing power against inflation during volatile economic times, and it holds its value.

Let's Talk Diamonds:

Deep within the dark crevasses of the earth under the earth’s crust are deposits of carbon. The carbon is subjected to high temperature and pressure, and as a result, the dark carbon transforms into a crystal clear beauty. Some diamonds are formed within a few days, while others are formed after millions of years of temperature and pressure. The highly pressurized carbon bi-products are exquisite.

Diamonds are found in kimberlite rocks and alluvial deposits. Kimberlite rocks are rocks that occur in od volcanic pipes. Water, waterfalls, and streams erode the channels, and the diamonds are deposited.

Alluvial Diamond Mining

Miners mine diamonds by diverting water through prebuilt walls to shift diamond-bearing dirt. It takes time to have the diamonds come to the earth’s crust located in rivers and stream beds to be harvested.

Pipe Mining

This type of mining is the most common form of diamond mining. Miners use open-pit diamond mining or underground diamond mining to get closer to the kimberlite pipes that hold the diamonds.

Open-pit mining is closer to the earth’s surface. As miners remove sand and gravel, the process exposes kimberlite rocks.

Underground mining is accomplished by building two parallel and vertically connected tunnels. Miners in the top tunnels will blast the kimberlite rocks, and the ore is collected in the bottom tunnel.

Marine Mining

Marine diamonds are found and taken from the ocean floor using sophisticated mining ships. Gravel is vacuumed from the ocean floor and run through a screening process that holds the diamonds and washes the rock. Sometimes other operations use a large ship that drills down into the ocean floor so gravel is brought to the surface so the diamonds can be extracted. The result is beautiful diamonds available to buyers seeking to purchase diamonds.

Diamond Mines

Historically, Africa produced 90 percent of the global diamond supply, and Russia has the most gem-quality diamonds globally, followed by Botswana, Canada, Angola, and South Africa. There are only about 20 major commercial diamond mines in existence today.

Diamond Grading

The 4cs grade diamonds. Knowing what this means is essential so the buyer can understand a diamond’s value and how the grading affects the diamond prices.

1. Diamond Color Means Lack of Color

A Diamond with no color, like a drop of water, is valued higher than a diamond with some color. All diamonds are evaluated from D (diamonds with no color) to Z (diamond with color).

Under controlled lighting, a diamond expert compares the diamond to “master stones” to determine the absence of color and gives the diamond a rating.

2. Diamond Clarity

Diamond Clarity refers to the absence of “inclusions” (substances, spots, etc. included in the structure of the diamond) and “blemishes” (external characteristics). Diamonds are created under pressure and heat, and as a result, they have both inside and external elements that need to be evaluated by size, nature, position, and relief. How do the blemishes and inclusions affect the overall appearance of the diamond? Clarity equals purity.

Clarity rating is given after looking at the diamond under powerful magnification and determining its inside characteristics (inclusions). A Diamond Clarity Scale provides the diamond with an overall clarity rating.

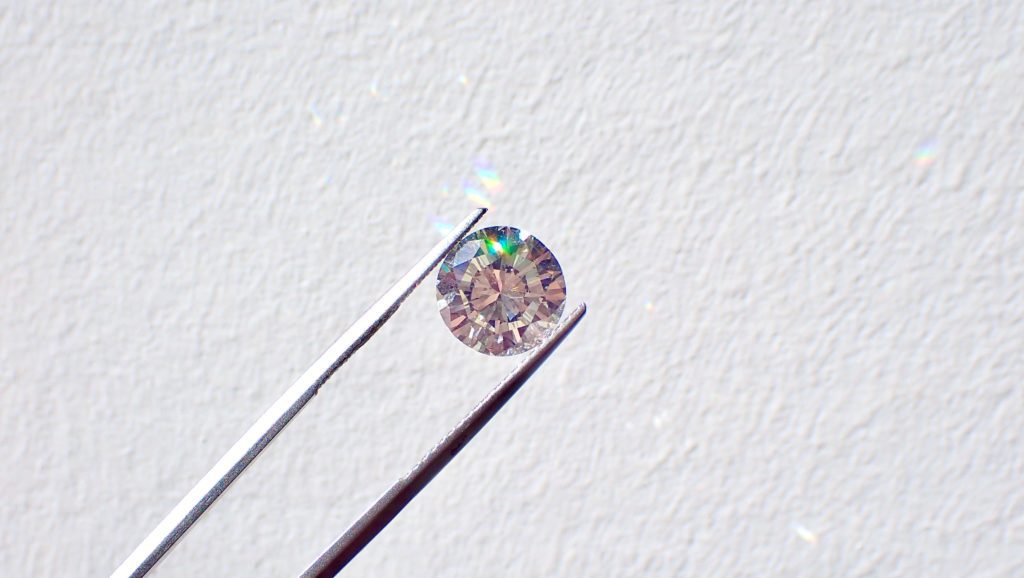

3. Diamond Cuts

Knowing how your diamond is cut is essential in understanding your diamond and its value and ability to transmit light and sparkle. Some diamonds are cut round, heart-shaped, oval, marquise, and pear. A skilled gem cutter will know precisely how to cut a diamond, so it interacts with the light to enhance its beauty and value. This is an art and adds to the value of the diamond.

4. Carat weight

A carat is defined as 200 milligrams when weighing a diamond. The weight of a diamond is given within a hundredth decimal place. Larger diamonds are rarer and thus more valuable and desirable. Remember that the value of a diamond is not only its weight but also the color, clarity, and cut.

Diamonds As An Investment Opportunity

Today the market is unstable, and communities are seeing an increase in inflation. Diamonds can be profitable. Diamonds are valuable stones as an investment no matter how much fluctuation is seen in the world market. Because of their reliability, they will retain their value for the long run. Diamonds also have an excellent resale value making them a significant investment.

Being knowledgeable about the 4cs when you are purchasing diamonds can be under-emphasized.

A cheap, cloudy, chipped diamond with flaws is practically worthless compared to an extremely clear, well-cut, inclusion-free 1k diamond.

Knowing what you are buying and understanding diamond prices are essential when determining future resale value.

Diamonds are considered more durable and movable, making them an excellent investment.

In the wholesale market, diamonds are priced per carat weight, and larger diamonds are rarer and thus worth more.

According to the Diamond Price Index, on January 1, 2022, “diamond prices moved HIGHER by an average of 7.4% in December 2021. The average price per carat of all diamonds in our database was $12,047.77, up from $11,212.56 a month ago.”

Diamond prices fluctuate with the current market value. One carat diamonds are sought after and valuable due to their rarity.

Diamonds are considered a more durable and movable investment, making them excellent.

Gold and Diamonds as a Double Investment

Looking for a haven for your savings and investments, go with gold!

If you consider a solid resale value for the long run, go with diamonds!

How about shopping for gold and diamond jewelry?

Gold jewelry is mainly made from gold that is 18k or less. 24k gold is too soft and scratches easily, and it is used in gold coins and gold bullion. These would be great to consider when purchasing gold as an investment.

If you consider investing in diamonds, a one-carat diamond is valuable, and it would be a welcome investment.

Initially, you would have to invest a few thousand dollars to purchase a quality one-karat diamond in today’s market. Still, over time the diamond would hold its resale value. Notably, 1k or larger diamonds are rare and have a great resale value.

You decide to invest in gold coins and gold bullion when considering investment opportunities. But you don’t have to invest in only gold. Gold and diamonds contained in luxury jewelry would be well worth considering. You could have the best of both worlds. Gold and diamonds set together in an engagement set or a clear diamond complemented by colored diamonds in a delicate gold setting to bring its beauty together would be fun to design as well as hold on as an investment.

Both gold and diamonds are valuable, and together they complement each other. Physical gold can be an investment and set aside to offset inflation during a poor economy. A diamond is a precious stone when held on to for years, and it has excellent resale value. Focusing on enhancing your gold investment with diamonds isn’t considered a risky investment but will increase your investment options and bring you a higher value in the long run.

Pawnshops are a great place to buy and sell gold, whether for investment purposes or for making your dreams come true. Pawnshops have both gold and other rare precious metals. They also have loose natural diamonds and diamonds set in gold settings for an affordable price.

During economic uncertainty, investment options are wise to consider.

Visiting your local pawn shop will give you ideas and options to consider. They have genius marketing strategy options like opt-in programs to save you money or give you a higher percentage when selling gold or diamonds outright. They are knowledgeable about investing in gold and silver too. Potential investors will often find precious gems and find they can buy gold from pawnshops such as old or scrap gold and use it as an investment.

The stock market is affected by external factors, and it is volatile right now. Considering how you can expand and spruce up your investment portfolio is smart.

Parker Pawn and Jewelry

At Parker Pawn and Jewelry, we love diamonds, gold, gold coins, silver, and luxury jewelry. We understand how gold jewelry can be an excellent investment, valid for diamonds. Some jewelers will tell you that synthetic diamonds are not suitable to have as a better investment when compared to earth-mined diamonds; however, they both hold their resale value.

Do you have gold or diamonds, or gold and diamond jewelry that is just laying around in your jewelry box, and you don’t use it but need some quick cash?

We will buy directly gold or diamonds or use them for a collateral pawn loan.

We will set it on our shelves for re-purchase when we buy diamond jewelry. We have genius marketing strategy options like our opt-in program, so your name can be included on a gold or diamonds niche list. Hence, you receive sale notifications and other perks for being a part of our pawnshop.

Some other factors to consider are to look for other valuable items in your garage or strongbox. Maybe these valuable items can be used to trade or purchase gold to add to your nest egg.

You may have a name-brand power tool that isn’t being used, and you can come in and discuss using its collateral to invest in gold and silver. The tool will not have the same return compared to gold or silver in the long run, and if it sits unused for years, it will be practically worthless while collecting dust.

Gold, silver, or a one-karat diamond sitting in your safe will only be worth more over time and a safe investment. Potential investors come into our store often looking for suitable precious metals to add to their gold investment.

The gold supply will decrease, but the demand will change. The diamond supply finds options for large diamonds, making them more rare and valuable. Coupling gold and diamonds when looking at investment opportunities may be just the perfect option, and there are vital factors to consider. Come by and visit with us at Parker Pawn and Jewelry Today!